12V 6Ah Lithium ion Battery Lifepo4 Battery

12V 10Ah Lithium ion Battery Lifepo4 Batteries

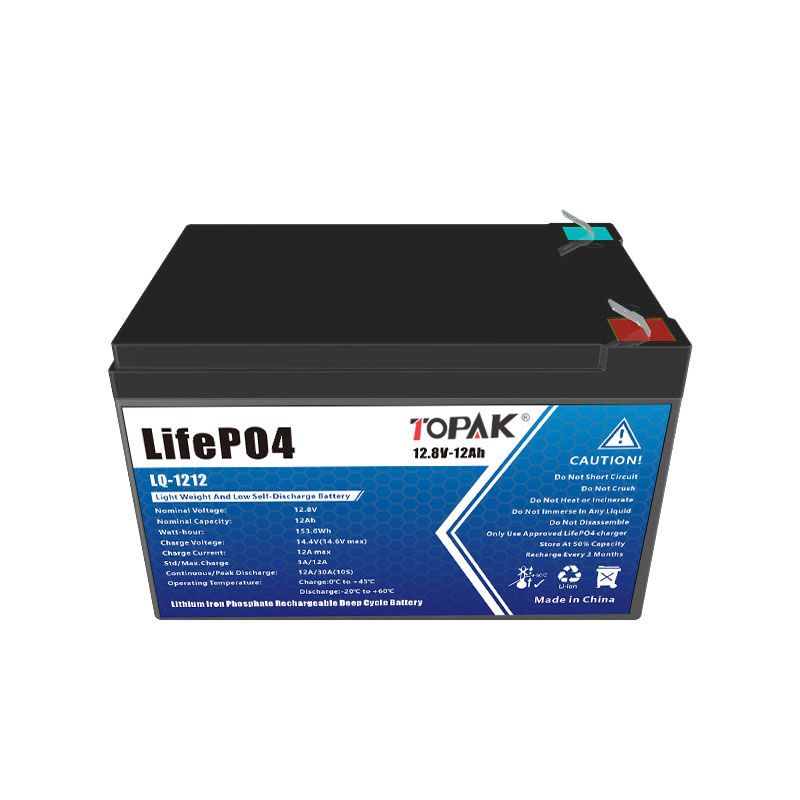

12V 12Ah LiFePO4 Lithium Iron Phosphate Battery

12V 18Ah Lifepo4 Lithium Battery Cell

12V 20Ah replacement Lead acid Lithium Battery

12V 36Ah Lithium Iron Phosphate Battery

24V 50Ah Lifepo4 Battery Lithium ion Battery

24V 100Ah lifepo4 iron batteries replacement lead acid lithium battery

24V 200Ah lifepo4 battery replacement Lead acid Lithium Battery

48V 50Ah Lithium Iron Phosphate Battery replacement Lead acid Lithium Battery

48V 100Ah lithium batteries replacement lead acid lithium battery

TOPAK 51.2V 300AH Vertical Home Energy Storage Battery

TOPAK 48V 100Ah Home Rack Mounted Energy Storage Batteries

TOPAK 51.2V 100Ah Stackable Battery Shunt able Solar Battery

TOPAK 24V 200Ah Solar Household Wall mounted Battery

48V 1000Ah household Photovoltaic energy storage split type machine

TOPAK 5KWA+5KWh Vertical Home Solar Inverter Energy Storage Integrated Machine Parallelable

384V 100Ah Backup power supply 38.4kWh UPS Data Center Power System

384V 50Ah Backup power supply 19.2kWh UPS Data Center Power System

192V 100Ah Backup power supply 19.2kWh UPS Data Center Power System

192V 50Ah Backup power supply 9.6kWh UPS Data Center Power System

224V 100Ah UPS Power System 22.4kW LiFePO4 Battery System

TOPAK 224V 30Ah Lithium ion UPS lifepo4 Battery 6.7KW UPS Backup

48V 150Ah tower energy stroage battery ofr backup power supply,home/hopital/bank/small business/base station use

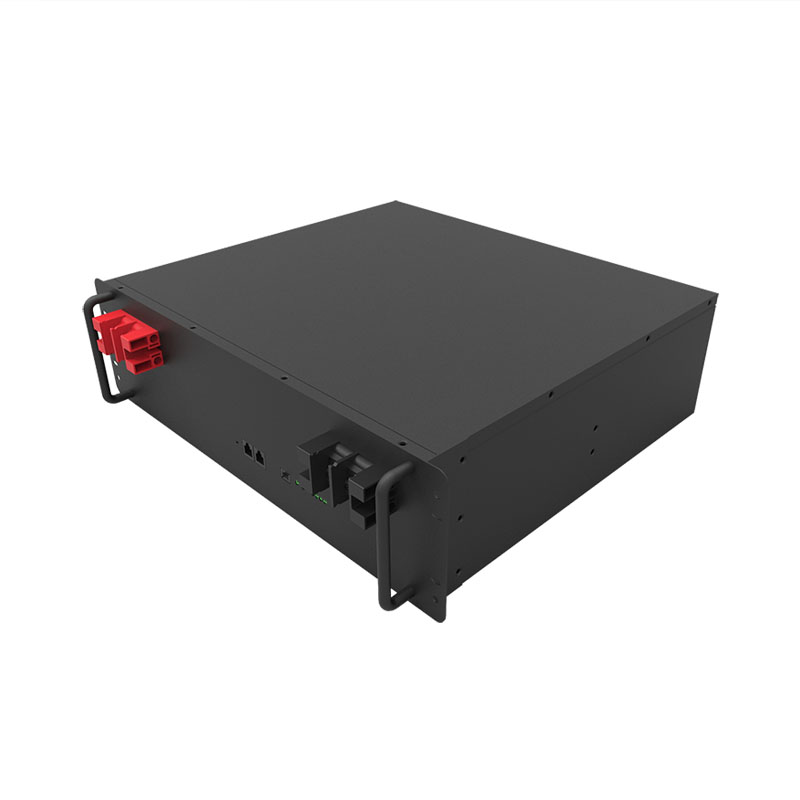

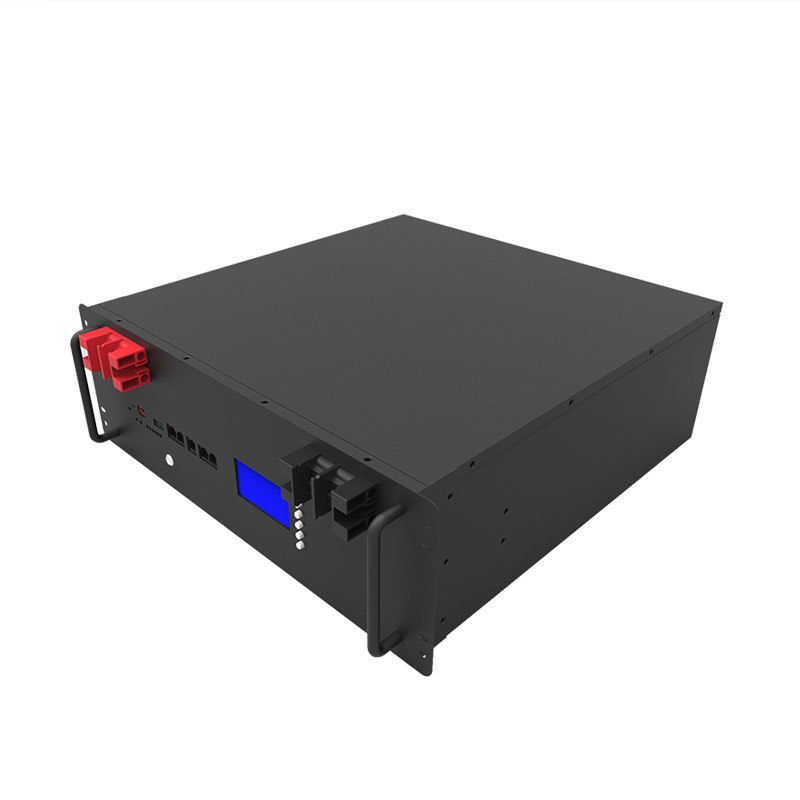

48V 100Ah(5U) tower energy stroage battery ofr backup power supply,home/hopital/bank/small business/base station use

Topak tower energy stroage battery for backup power supply,home/hopital/bank/small business/base station use

Topak 48V 100Ah Lithium ion battery BMS Solar Energy Storage System Lifepo4 Battery

48V 200Ah tower energy stroage battery ofr backup power supply,home/hopital/bank/small business/base station use

48V 100Ah(4U) tower energy stroage battery ofr backup power supply,home/hopital/bank/small business/base station use

12V 100Ah Lifepo4 Battery Patent design lithium battery

TOPAK RV Lifepo4 Battery 12V 400ah Energy Storage Lithium iron Phosphate RV Battery

51.2V20AH Lithium battery for electric bicycle battery converter

10.8V2.1AH Massager lithium battery

29.6V7.5AH Reserve power supply lithium battery

64V100Ah electric tricycle lithium battery

Writer: TOPAKRelease time: 2023-11-20Page View: 26

In the United States, in addition to favorable natural conditions in certain regions, policies to support energy storage funds, and pressure from high electricity bills, some other factors are also stimulating the combined application of optical storage systems.

Initially, Investment Tax Reduction (ITC) was a tax reduction policy introduced by the government to encourage green energy investment. Photovoltaic projects could deduct 30% of the investment amount from their taxable income. The cost accelerated depreciation method is a tax guideline issued by the United States Tax Administration, which stipulates that photovoltaic systems constructed after December 31, 2005 can adopt the cost accelerated depreciation method, which means that the depreciation amount of fixed assets gradually decreases according to the age of the equipment.

In 2016, the American Energy Storage Association submitted the ITC bill to the United States Senate, clarifying that advanced energy storage technologies can apply for investment tax exemptions and can operate independently or through integration into microgrids and renewable energy power generation systems.

To promote the coordinated development of energy storage and renewable energy, policies also require that 75% of the electricity stored in energy storage systems must come from renewable energy in order to enjoy ITC support. This support ratio is 30% of the system investment, and by 2022, this support ratio will decrease to 10%. When the energy storage system stores renewable energy for power generation between 75% and 99%, it can enjoy partial ITC support. Only when the energy storage system is fully charged by renewable energy can it fully enjoy ITC support.

At the same time, energy storage systems without supporting renewable energy can use a 7-year cost accelerated depreciation, which is equivalent to a 25% reduction in capital costs. Energy storage systems that use renewable energy to charge less than 50% may not meet the ITC support standards, but they can still enjoy the same cost accelerated depreciation support. Energy storage systems with a ratio higher than 50% can use a 5-year accelerated depreciation, equivalent to a 27% reduction in capital costs.

ShenZhen Topak New Energy Technology CO.LTD.

+86 15920229894

Phyllis@topakpower.com

Address: 26 Yingfeng 1st Road, Dalang Town, Dongguan City, Guangdong Province (Tuopai Industrial Park)

Copyright © 2019 Shenzhen topak new energy technology CO.LTD. 粤ICP备20054061号